The housing industry expected mortgage rates to come down in 2025. Then Donald Trump got elected president and the Fed cast doubt on how much—and how quickly—it would cut rates.

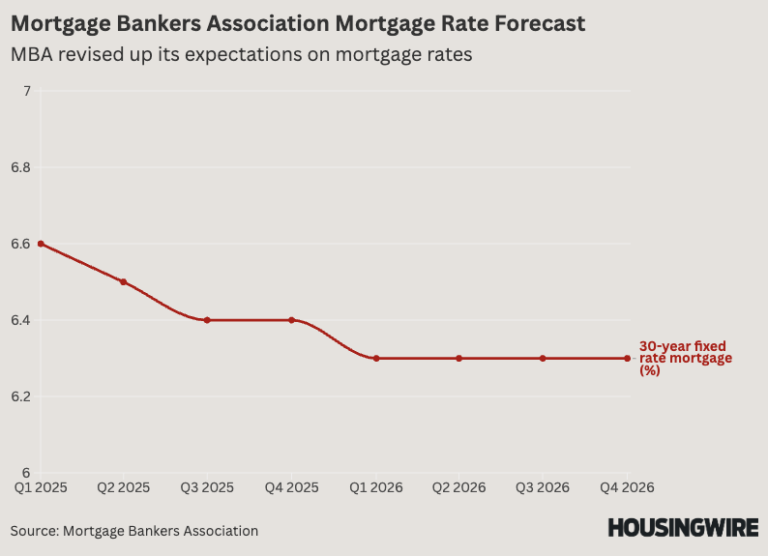

The latest sign that views on interest rates are changing comes from the Mortgage Bankers Association (MBA), which has released its monthly mortgage finance forecast. MBA now expects mortgage rates to range between 6.4% and 6.6% in 2025, while holding steady at 6.3% in 2026.

In October, when there was more optimism about the pace of Fed rate cuts, the trade organization projected rates to be between 5.9% and 6.2% in 2025, and at 5.9% in 2026.

In its November forecast, Fannie Mae also revised its expectations on mortgage rates. Previously, it projected mortgage rates to dip below 5%, but now it expects rate at 6.3% in 2025 and above 6% in 2026.

MBA’s November forecast includes other changes in other housing activity that would be affected by higher mortgage rates. It expects mortgage origination volume to be $2.1 trillion in 2025, while the October forecast predicted volume at $2.3 trillion.

Additionally, MBA’s updated forecast projects slightly lower home sales in 2025, with existing homes selling at a seasonally adjusted annual rate of 4.25 million, as opposed to the October forecast, which projected 4.3 million. The change in projection for new homes sales in the updated forecast is negligible.

HousingWire’s 2025 housing market forecast projects 4.2 million existing home sales, as does Goldman Sachs’s. Of the forecasts HousingWire analyzed, the National Association of Realtors has the highest projection at 4.9 million.

MBA isn’t the only forecast revising home sales downward. Fannie Mae dropped its expectations for home sales growth in 2025 from 11% to 4%.

After a summer in which both the 15-year and 30-year conforming mortgage rates were about 7%, mortgage rates dropped considerably, bottoming out at the beginning of October. The 15-year conforming rate dropped into the mid-5% range, and the 30-year fell below 6.5%.

However, rates rose dramatically in October and both the 30-year and 15-year are right at about 7%.

The Federal Reserve was expected to make several interest rate cuts in the coming months, but Trump’s election clouds that outlook because of his proposals on tariffs. At various points in the 2024 campaign, Trump proposed a 10% blanket tariff on foreign goods, a 60% tariff on Chinese goods and a 100% tariff on Mexican goods.

Economists widely believe that tariffs of this magnitude would reignite inflation and force the Fed to pause interest rate cuts, or even prompt it to raise them.